JPMorgan projects that Bitcoin will reach a new all-time high in 2026, driven by the expected passage of the CLARITY Act and the massive influx of institutional capital.

JPMorgan analysts, led by managing director Nikolaos Panigirtzoglou, have issued a bullish projection that places the value of Bitcoin at a new all-time high (ATH) for the end of 2026.

Their recent Bitcoin price estimate is based on a structural shift in the global financial market, where the leading cryptocurrency has demonstrated superior technical resilience after overcoming adjustments to its mining difficulty and episodes of extreme volatility. The investment bank notes that, following a period of capitulation by high-cost miners, the asset has consolidated solid support near $70.000. However, the determining factor for reaching the new six-figure target is not retail behavior, but rather... Imminent massive integration of Bitcoin into the balance sheets of large financial institutions under a new regulatory framework in the United States.

Buy Bitcoin before it reaches six figuresThe CLARITY Act as a catalyst for institutional flow into Bitcoin

JPMorgan analysts' optimism for Bitcoin in 2026 rests primarily on legislative progress. CLARITY Act (Clarity for Payments Act).

According to the bank's report, this legislation represents the definitive bridge for banking institutions and hedge funds to operate with digital assets under clear and secure supervision. The Trump administration has expressed explicit support for this legislation, aiming for Senate ratification of the bill before the midterm elections in November 2026.

The approval of This law would allow institutional capital to flow massively into Bitcoin, shifting the weight that the retail sector has historically had in price formation.

Patrick Witt, White House advisor on digital assets, argues that the intention behind the CLARITY Act is to move the market away from its deregulated phase and toward a system backed by traditional banking. JPMorgan highlights that Bitcoin, increasingly perceived as a reserve asset comparable to gold, will benefit from appreciation due to scarcity and financial utility once the legal environment offers the necessary guarantees for large capital investments. According to analysts, The leading cryptocurrency could reach a value of $266.000 per coin during the course of this year.

Source: CoinGecko

From mining adjustment to global expansion: Bitcoin prepares for a historic leap

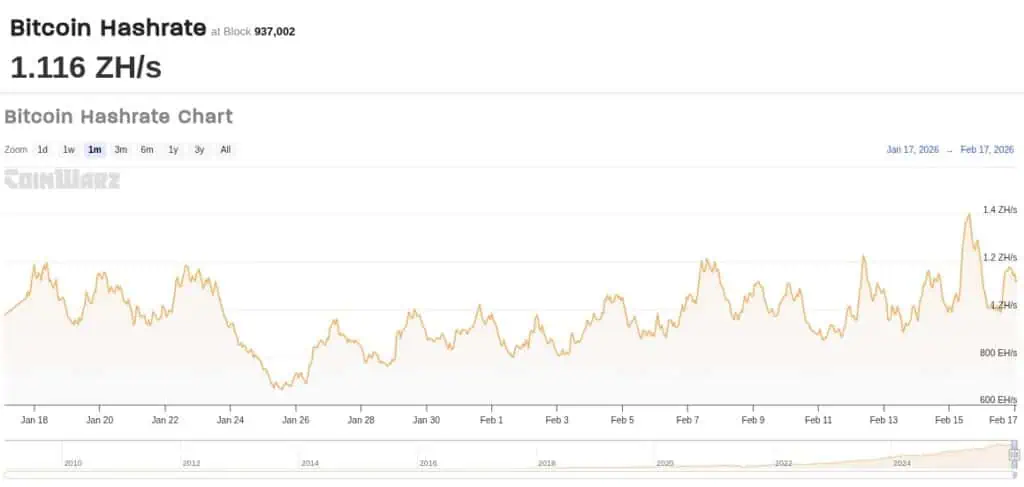

Despite the fact that the cost of Bitcoin production fell from $90.000 to $77.000 due to weather conditions in Texas (USA) and the shutdown of inefficient equipment, the network's hashrate has begun an accelerated recovery. In fact, data from the Coinwarz platform shows that Bitcoin's global computing power is 1,178 ZH/s at the time of writing this article.

Source: Coinwarz

According to JPMorgan, this recovery in the network's hash rate confirms the strength of Bitcoin's infrastructure: only the most efficient miners remain operational, stabilizing the network and paving the way for an increase in mining difficulty. Experts interpret this ecosystem cleanup as a sign of long-term health that precedes all-time high cycles.

Alongside its price projections, JPMorgan has strengthened its own infrastructure for this scenario. Through its Kinexys unit, the bank is expanding the use of its digital token and preparing cryptocurrency custody services for Bitcoin and Ethereum. This move aligns with the trend of other Wall Street giants, such as Goldman Sachs, which have integrated digital assets into their investment portfolios.

The convergence between the technical robustness of the Bitcoin protocol and the creation of its own banking infrastructure suggests that the $266.000 target is based on an analysis of limited supply versus unprecedented institutional demand which is about to begin.

Buy Bitcoin, the digital economy's reserve currencyRegulation, mining and trust

In summary, the US bank argues that, as market pessimism dissipates and a stable regulatory framework for cryptocurrencies is established in the United States, Bitcoin will be in a position to directly challenge gold's status as principal global store of value.

The progress of the CLARITY Act, along with the support of the US Executive branch and the growing maturity of the mining sector, is building a more solid and predictable environment. All of this suggests that 2026 could mark a turning point, when the most capitalized cryptocurrency in the industry surpasses its own limits and consolidates itself as a central pillar in the structure of the new global digital economy.

Basic Bitcoin Course

Basic levelStart from scratch in Bitcoin in a clear, easy, safe and quick way. This course is specially designed for beginners practically know nothing about Bitcoin.